Finding the right auto insurance in Fayetteville, North Carolina can seem tough. The average cost for full coverage is $1,305 a year, which is over 30% higher than the state average. But, smart drivers can find good deals by shopping around and looking at different options.

In Fayetteville, there are many good insurance choices. Companies like Nationwide, Erie, and North Carolina Farm Bureau offer some of the best deals on coverage. By knowing what affects rates in Fayetteville and using discounts, drivers can get the right protection without spending too much.

Key Takeaways

- The average cost of full coverage car insurance in Fayetteville is $1,305, significantly higher than the North Carolina state average of $1,084.

- Erie offers the lowest rates in Fayetteville, with an average of $872 for full coverage.

- Nationwide and Erie provide the most affordable minimum and full coverage policies in Fayetteville.

- Drivers can save on car insurance by comparing quotes from different providers and taking advantage of available discounts.

- Understanding the unique factors that influence rates in Fayetteville is key to finding the best coverage.

The Importance of Car Insurance in Fayetteville

Having car insurance is key for drivers in Fayetteville, North Carolina. The state has a high rate of traffic accidents. The car insurance requirements north carolina say all drivers must have a certain amount of coverage. This protects everyone on the road.

Understanding North Carolina’s Minimum Coverage Requirements

North Carolina law requires all drivers to have at least:

- $30,000 per person and $60,000 per accident in bodily injury liability coverage

- $25,000 in property damage liability coverage

- $60,000 in uninsured/underinsured motorist bodily injury coverage per accident, $30,000 per person

- $25,000 in uninsured/underinsured motorist property damage coverage per accident

If drivers don’t meet these minimums, they could face penalties and legal trouble in Fayetteville. It’s vital for people to know and follow the state’s car insurance laws. This helps avoid financial and legal risks.

“Car insurance provides financial protection for damages to cars, drivers, passengers, and more in Fayetteville.”

Factors Affecting Car Insurance Rates in Fayetteville

In Fayetteville, North Carolina, many things can change how much you pay for car insurance. Your age, gender, credit score, driving history, and even your ZIP code’s crime rate and claims can affect your rates. This means your location in Fayetteville can play a big role in what you pay for insurance.

For example, Erie Insurance has the lowest liability insurance in Fayetteville, costing about $33 a month or $399 a year. But, if you’re 16, you might pay around $166 a month or $1,986 a year for insurance.

| ZIP Code | Full Coverage Insurance | Liability Insurance Coverage |

|---|---|---|

| 28301 | $100 | $40 |

| 28302 | $110 | $40 |

| 28303 | $110 | $40 |

| 28304 | $100 | $40 |

| 28345 | $100 | $40 |

| 28346 | $100 | $40 |

Your driving record also plays a big part in your insurance costs. A speeding ticket can raise your rates by 97%, and an accident by 126%. A DUI can increase your premiums by as much as 401%.

Where you live in Fayetteville can also change your insurance rates. Some ZIP codes might be cheaper or more expensive than others. Suburban areas usually have lower rates than busy city areas.

Knowing these factors helps you make better choices when looking for car insurance. To get the best rates, compare quotes from different insurers. Pick the policy that suits your needs and budget.

Cheapest Car Insurance Companies in Fayetteville NC

Finding the most affordable car insurance in Fayetteville is key for drivers. They want to get good coverage without spending too much. Some of the cheapest car insurance companies in the area are:

- Erie – Erie offers full coverage for about $872 a year and liability-only for $41 a month. It’s a top choice for saving money in Fayetteville.

- Nationwide – Nationwide has liability-only coverage for around $311 a year. It’s a great option for those on a budget in Fayetteville.

- Farm Bureau – Farm Bureau has both full and minimum coverage that’s among the cheapest in the area.

- State Farm – State Farm is a trusted name with competitive rates for affordable car insurance fayetteville nc. Full coverage averages $1,044 a year.

These insurers are among the cheapest car insurance companies fayetteville nc. They offer quality coverage at good prices for Fayetteville drivers.

“New car insurance customers report savings of nearly $50 per month with State Farm.”

By comparing quotes from these top providers, Fayetteville residents can find the best cheapest car insurance companies fayetteville nc. They can get good coverage that fits their needs.

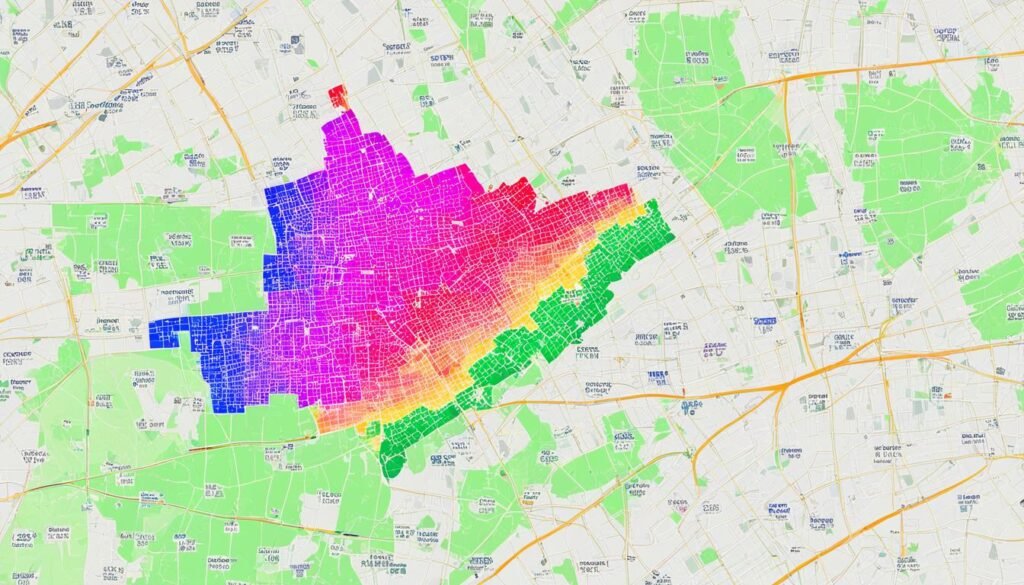

auto insurance fayetteville nc: Rates by ZIP Code

When looking for car insurance in Fayetteville, NC, ZIP codes matter a lot. Our research shows that car insurance rates by zip code fayetteville nc change a lot across the city. The cheapest car insurance fayetteville nc by zip code is in the 28312 area, costing about $1,132 a year. On the other end, the 28301 ZIP code has the highest rates, at $1,339 annually.

Some ZIP codes in Fayetteville, like 28304 and 28314, can be cheaper or pricier than average. This highlights the need to compare rates across different neighborhoods. It helps you find the best deal for where you live.

| ZIP Code | Average Annual Rate |

|---|---|

| 28312 | $1,132 |

| 28301 | $1,339 |

| 28304 | $1,205 |

| 28314 | $1,270 |

Knowing how car insurance rates by zip code fayetteville nc work helps you make a smart choice. You can find the cheapest car insurance fayetteville nc by zip code that suits your budget and needs.

Choosing the Right Coverage for Your Needs

Liability, Collision, and Comprehensive Coverage Explained

In Fayetteville, NC, knowing about auto insurance is key. North Carolina is an at-fault state. So, drivers must have liability insurance to cover damages or injuries they might cause. It’s wise to choose higher liability limits for full financial protection.

Collision coverage is vital for fixing or replacing your car after an accident. Comprehensive coverage helps with non-collision issues like theft, vandalism, or natural disasters. By looking at types of car insurance coverage fayetteville nc and liability vs collision vs comprehensive coverage fayetteville nc, drivers in Fayetteville can pick the best policy for their needs and budget.

| Coverage Type | What it Covers | Why it Matters |

|---|---|---|

| Liability | Damages or injuries to other parties in an accident you cause | Legally required in North Carolina, but higher limits offer better protection |

| Collision | Repairs or replacement of your vehicle if damaged in a collision | Protects your investment in your car and ensures you can get back on the road |

| Comprehensive | Non-collision related damages, such as theft, vandalism, or natural disasters | Provides comprehensive protection for your vehicle beyond just accidents |

Understanding types of car insurance coverage fayetteville nc and the differences between liability vs collision vs comprehensive coverage fayetteville nc helps drivers in Fayetteville. They can make smart choices and pick the right coverage to protect themselves and their cars.

Discounts and Ways to Save on Car Insurance

As a driver in Fayetteville, North Carolina, finding ways to save on your car insurance is key. There are many discounts and strategies to lower your monthly premiums. These can help you get the best coverage for your needs.

One easy way to save on car insurance discounts fayetteville nc is by using available discounts. Many insurance companies offer discounts for safe driving, being a student, military service, and more. Always ask about these discounts when looking for a policy to save more.

Another great way to save on car insurance fayetteville nc is to compare quotes from different insurance companies. Rates can change a lot between providers. It’s important to research and find the best deal for you. Shopping around before each renewal can help you keep up with market changes.

Bundling your auto insurance with other policies, like homeowner’s or renter’s insurance, can also save you a lot. This lets you combine your coverage and possibly save a big amount on your insurance costs.

The secret to finding the best car insurance discounts fayetteville nc and ways to save on car insurance fayetteville nc is to stay informed. Always look at all your options and work with your insurance provider to make sure you’re getting good value for your money.

High-Risk Drivers and Car Insurance in Fayetteville

In Fayetteville, North Carolina, car insurance rates go up a lot for drivers seen as “high-risk.” This includes people with a history of accidents, moving violations, or DUI convictions. A speeding ticket can raise rates by up to 97%. An at-fault accident can increase them by 126%. And a DUI can make rates jump by a huge 401%.

For high-risk car insurance in Fayetteville, NC, or car insurance for drivers with violations in Fayetteville, NC, some insurers offer better deals. Erie Insurance, Nationwide, and National General are often the best choices for high-risk drivers in the area.

“Drivers with blemished records should shop around to find the most competitively priced coverage that meets their needs,” advises local insurance expert, Sarah Wilkins. “Being proactive and comparing options can help high-risk drivers in Fayetteville manage their insurance costs.”

By knowing what makes a driver high-risk and looking at insurers that offer better rates, drivers in Fayetteville can find good insurance. This way, they can get coverage that suits their specific situation.

Tips for Finding the Best Auto Insurance in Fayetteville

Looking for the best car insurance in Fayetteville, NC? It’s key to compare quotes and check customer service. With many options out there, drivers in Fayetteville should research to find what fits their budget and needs.

Comparing Quotes and Evaluating Customer Service

Comparing auto insurance quotes from different providers is crucial. Prices change based on your age, driving record, and where you live. So, it’s smart to look at various options.

It’s also important to look at customer service. Good support is as valuable as a low price when picking insurance. Check out reviews and ratings from Fayetteville customers to see how companies perform.

| Insurance Company | Average Rate (Fayetteville) | Customer Service Rating |

|---|---|---|

| Geico | $101 per month | 4.4 out of 5 |

| State Farm | $115 per month | 4.2 out of 5 |

| Nationwide | $120 per month | 4.0 out of 5 |

| Allstate | $125 per month | 3.8 out of 5 |

| NC Farm Bureau | $133 per month | 4.1 out of 5 |

By shopping around and looking at all the factors, drivers in Fayetteville can find great car insurance coverage. It’s all about finding what works best for you and your budget.

“Comparing quotes and evaluating customer service are key steps in finding the right auto insurance in Fayetteville. Don’t settle for the first option – explore your choices to get the best coverage and support.”

Conclusion

Finding the right auto insurance in Fayetteville, NC means looking at many factors. These include the minimum coverage needed, your driving history, where you live, and discounts you might get. Even though car insurance in Fayetteville is often more expensive than the state average, you can still find good deals.

By comparing quotes from top companies like Erie, Nationwide, and North Carolina Farm Bureau, drivers can save money. Understanding what coverage you need and shopping around helps you protect your car and wallet. This is true whether you’re a new driver or have been driving for years.

Remember, the minimum coverage in North Carolina might not protect you enough. You might want to look into extra coverage like uninsured/underinsured motorist protection and comprehensive coverage. With the right policy, you can drive with confidence and enjoy all Fayetteville has to offer.

5 Comments

Pingback: Auto Insurance Abilene TX: Find Your Best Coverage

Pingback: Car Insurance Richmond VA: Best Rates & Coverage

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Pingback: Car Insurance Quotes Raleigh: Find Affordable Coverage

What is the average cost of a full car coverage insurance policy in Fayetteville, North Carolina?