Finding affordable car insurance in Yuma, Arizona is key for drivers here. Yuma offers many coverage options and competitive rates. This means you can get the right protection without spending too much. Whether you need basic or full coverage, there’s a plan for you.

Key Takeaways

- The average cost of full coverage car insurance in Yuma is $1,431 per year, but rates can vary based on factors like age, driving history, and credit score.

- Root and Auto-Owners Insurance offer some of the lowest average rates for full coverage in Yuma.

- Arizona requires minimum coverage of $25,000/$50,000 in bodily injury liability and $15,000 in property damage liability.

- Customizing car insurance policies by adjusting liability limits and deductibles can help Yuma drivers find the right balance between coverage and cost.

- Discounts and bundling options may also help Yuma residents save on their car insurance premiums.

The Importance of Car Insurance in Yuma, AZ

In Yuma, Arizona, car insurance is a must-have, not just a luxury. Drivers must have at least $25,000 per person/$50,000 per accident in bodily injury liability coverage and $15,000 in property damage liability coverage. This coverage protects you if you’re at fault in an accident. It ensures you don’t pay for all the damages or medical bills of others.

Understanding the Minimum Coverage Requirements

Yuma’s minimum coverage seems simple, but experts suggest getting more coverage. They recommend adding collision and comprehensive coverage for better protection. This way, you’re covered for accidents, theft, or other unexpected events.

- Bodily Injury Liability: Covers injuries to others if you’re at fault in an accident.

- Property Damage Liability: Covers damage to another person’s vehicle or property if you’re at fault.

- Collision Coverage: Pays for fixing or replacing your vehicle after a collision.

- Comprehensive Coverage: Covers damage to your vehicle from theft, vandalism, or natural disasters.

Knowing the minimum coverage and considering higher limits helps Yuma drivers stay safe on the roads. Looking for affordable car insurance is key to following the law and keeping your finances safe.

Factors Affecting Car Insurance Rates in Yuma

When looking at car insurance rates in Yuma, Arizona, many factors matter. Insurance companies in Yuma look at your age, driving record, credit score, the car you drive, and where you live. These things help decide how much you’ll pay for insurance.

For instance, living in areas with more crime or accidents can make your insurance costs go up. The type of car you have can also affect your rates. Cars that are luxury or high-performance usually cost more to insure.

Your age and how long you’ve been driving are big factors too. Younger or less experienced drivers, or those with bad driving records, often pay more for insurance.

To get the best rates, it’s important to compare quotes from different insurers. Factors that affect car insurance premiums in Yuma can change a lot, so it’s smart to look around. By knowing what determines car insurance rates yuma az, you can make better choices and find coverage that fits your budget.

“Comparing quotes from multiple insurers is the best way to find affordable car insurance in Yuma. The variables that impact auto insurance costs in yuma can vary significantly, so it’s important to explore all your options.”

Average Cost of Car Insurance in Yuma, AZ

In Yuma, Arizona, the cost of car insurance varies by coverage type. A full coverage policy costs about $1,394 per year or $116 monthly on average. For minimum liability coverage, the average cost is $1,258 annually.

Full coverage in Yuma can reach up to $3,884 yearly. Young drivers (16-20) pay an average of $2,158. But, senior drivers (55-65) pay about $573.

Breakdown of Costs by Coverage Type

Here’s how much car insurance costs in Yuma by coverage:

- Minimum Liability Coverage: $1,258 per year

- Full Coverage Policy: $3,884 per year

Costs can change a lot based on your driving record, age, credit score, and insurance company. By comparing quotes, Yuma drivers can save up to $2,626 a year.

“On average, drivers in Yuma can save up to $2,626 by comparing quotes from multiple car insurance companies.”

Cheapest Car Insurance Companies in Yuma

Finding the lowest car insurance rates in Yuma is key for many drivers. The best car insurance companies for cheap rates in Yuma are Root, Auto-Owners Insurance, and GEICO.

| Insurance Company | Average Annual Premium |

|---|---|

| Root | $816 |

| Auto-Owners Insurance | $911 |

| GEICO | $1,045 |

Even though the most affordable auto insurers in Yuma AZ focus on low prices, other factors matter too. Customer service, claims experience, and coverage options are important. Comparing quotes and evaluating the value can help Yuma drivers find the best deal.

“New car insurance customers report savings of over $50 per month with State Farm.”

Yuma has many affordable car insurance options. Drivers can find the right coverage at a good price. By looking at the lowest car insurance rates in Yuma and the value, Yuma residents can make smart choices and get the protection they need.

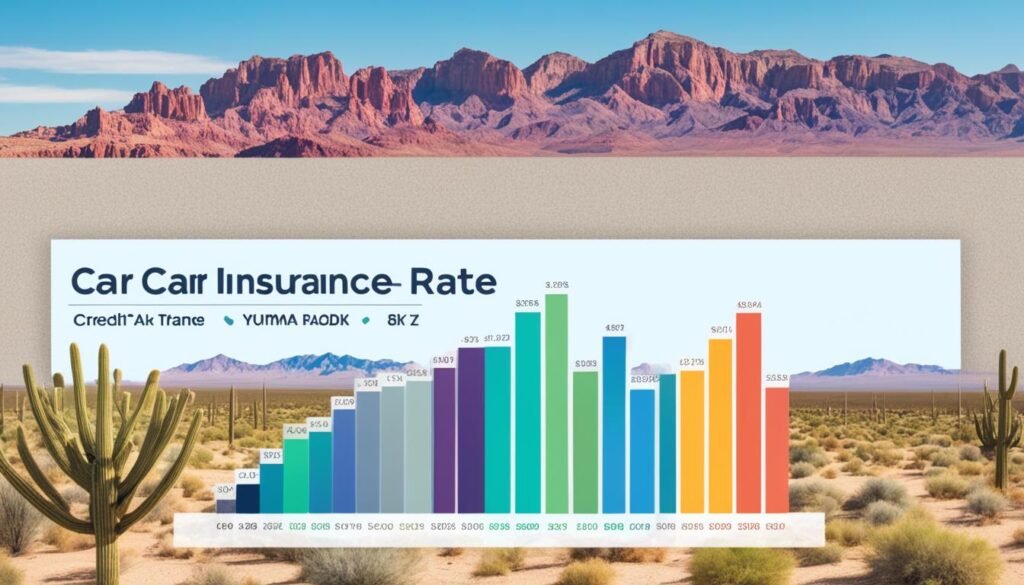

Car Insurance Rates by ZIP Code in Yuma

In Yuma, Arizona, where you live affects your car insurance rates. The car insurance costs by zip code can change a lot. Some areas have cheaper insurance options than others.

For example, drivers in the 85365 zip code pay about $1,424 a year for basic insurance. Those in the 85364 zip code pay around $1,438. These prices change because of crime rates, accident frequency, and parking availability in different areas.

| Yuma ZIP Code | Average Minimum Liability Rate | Average Full Coverage Rate |

|---|---|---|

| 85364 | $1,438 | $1,947 |

| 85365 | $1,424 | $1,910 |

Knowing how location affects auto insurance rates in yuma helps when looking for the best insurance. By comparing different yuma az zip codes, drivers can find affordable options that fit their budget and needs.

“The zip code you live in can significantly impact your car insurance rates in Yuma. It’s important to compare quotes across different areas to ensure you’re getting the best deal.”

Choosing the Right Car Insurance Company

Looking for the best car insurance in Yuma, Arizona, means more than just looking at prices. You want a company that offers affordable coverage, reliable service, and good protection for your driving needs.

Evaluating Cost, Coverage, and Customer Service

To find the best car insurance company in Yuma, compare different providers carefully. Here are important things to think about:

- Cost: Get quotes from several insurers to find the best rates. The cheapest car insurance in Yuma might not always be the best deal.

- Coverage: Check the types of coverage they offer, like liability, collision, comprehensive, and extra protections you might need. What to look for when buying car insurance in Yuma AZ should include enough coverage limits.

- Customer Service: Look into the company’s reputation for handling claims and customer service. Tips for finding the right auto insurer in Yuma include checking customer satisfaction ratings and reviews.

By looking at these factors, you can make a smart choice and find the best car insurance company in Yuma for your car and wallet.

“Choosing the right car insurance company is not just about finding the lowest price – it’s about finding the right balance of coverage, service, and value to meet your unique needs.”

car insurance yuma az for Drivers with Violations

Drivers in Yuma, AZ with moving violations like speeding tickets or a DUI will pay more for car insurance. Policygenius data shows the cheapest car insurance in yuma for drivers with violations is with Root Insurance. It costs about $870 a year for a driver with a DUI and $955 a year for a driver with a speeding ticket.

For auto insurance options for drivers with tickets or accidents in yuma, it’s key to shop around and compare quotes. High-risk drivers need to find affordable coverage since their driving records affect their premiums a lot.

- Root Insurance offers the cheapest car insurance in yuma for drivers with violations according to Policygenius data.

- Drivers with a DUI can expect to pay around $870 per year for car insurance with Root.

- Drivers with a speeding ticket can find the cheapest car insurance in yuma with Root, paying approximately $955 per year.

- Shopping around and comparing quotes is especially important for car insurance for high risk drivers in yuma to find the most affordable coverage options.

“For high-risk drivers in Yuma, finding the right car insurance coverage at an affordable price can be a challenge. However, by comparing quotes from multiple insurers, they can uncover substantial savings.”

Impact of Credit Score on Car Insurance Rates

In Yuma, Arizona, your credit score greatly affects your car insurance costs. Insurance companies use your credit history to set your rates. Drivers with poor credit pay much more than those with excellent credit.

According to Policygenius, the cheapest car insurance for a driver with bad credit in Yuma is Root at $1,008 a year. But, a driver with good credit can get coverage for as little as $600 a year with the same provider.

| Credit Score | Annual Premium |

|---|---|

| Excellent (800+) | $600 |

| Good (700-799) | $720 |

| Fair (600-699) | $840 |

| Poor (500-599) | $960 |

| Very Poor (499 or less) | $1,008 |

The data clearly shows how your credit score affects car insurance in Yuma. Drivers should know this and work on improving their credit for cheaper insurance.

“Your credit score is a big factor in your car insurance rates in Yuma, Arizona. Keeping a good credit history is key to low premiums.”

Discounts for Car Insurance in Yuma

Drivers in Yuma, Arizona, can save money on car insurance. There are many ways to cut costs, like bundling policies or keeping a clean driving record. These discounts can help you save on auto insurance in Yuma.

Bundling Discounts

One great way to save is through a bundling discount. If you insure your home and car with the same company, you could save up to 20% on your auto insurance.

Good Driver Discounts

Keeping a clean driving record also offers big savings. Insurance companies give big discounts to drivers with no accidents or tickets in the last few years.

Additional Savings Opportunities

- Defensive driving course discounts

- Multi-car discounts for insuring more than one vehicle

- Discounts for safety features like anti-theft devices or airbags

- Paperless billing and automatic payment discounts

By using these discounts, drivers in Yuma can save on auto insurance. This ensures they get the coverage they need without spending too much.

State Farm Car Insurance Options in Yuma

State Farm is the biggest auto insurance company in the U.S. It’s a top pick for drivers in Yuma, Arizona. They offer many coverage options like liability, comprehensive, collision, medical payments, and protection for uninsured/underinsured drivers.

State Farm doesn’t just cover cars. Yuma drivers can also get policies for luxury sports cars, campers, and other special vehicles. With 19,000 local agents, finding personalized quotes and advice is easy.

- State Farm is the largest auto insurance provider in the U.S. based on direct premiums written as of 2018.

- State Farm is recognized as the top home insurance company chosen by more homeowners compared to other insurers.

- State Farm offers a variety of affordable supplemental health, Medicare supplement, or individual medical coverage plans in Yuma, AZ.

- A Personal Articles Policy from State Farm can provide personal property coverage worldwide in case of theft, accidental damage, or loss.

- State Farm works with Trupanion®, a leader in high-quality pet medical insurance, to provide pet owners with the option to care for their pets without worrying about unexpected medical costs.

Looking for basic or full coverage? State Farm has what Yuma drivers need to stay safe. They focus on personalized service and offer many policy choices. State Farm is a reliable partner for state farm auto insurance in yuma az, state farm car insurance coverage in yuma, and state farm policy options for yuma drivers.

Auto-Owners Insurance: A Family-Friendly Choice

Looking for car insurance in Yuma, Arizona? Auto-Owners Insurance is a top pick for families. It’s affordable, with full coverage costing about $911 a year. This makes it the second cheapest in the city.

Auto-owners insurance yuma az is loved for its discounts and benefits for families. You can save money if your kids are good students or if they use monitoring tech. Bundling auto insurance with other policies like homeowners or life insurance also helps.

The auto-owners car insurance policy details for yuma offer personalized coverage. Even though it didn’t score high in customer satisfaction in the Southwest, it has a strong A++ (Superior) rating from AM Best. This means it can handle claims well.

So, why pick auto-owners for car insurance in yuma? It’s affordable, family-friendly, and financially solid. These reasons make it a great choice for car insurance in Yuma, Arizona.

“Auto-Owners is a great choice for families in Yuma who want reliable, budget-friendly car insurance with a personal touch.”

Mile Auto: Pay-Per-Mile Insurance for Low-Mileage Drivers

For Yuma, AZ drivers with low annual mileage, Mile Auto’s pay-per-mile insurance model could save you a lot of money. This model charges a low base rate plus a fee for each mile you drive. It’s perfect for retirees, work-from-home folks, or anyone who doesn’t drive much. Mile Auto doesn’t have a mobile app for managing policies, but it offers affordable full coverage rates in Yuma at just $84 per month.

The benefits of Mile Auto for low-mileage drivers in Yuma, AZ include:

- Pay only for the miles you drive, with a low base rate

- Potential for significant cost savings compared to traditional auto insurance

- Flexibility to adjust coverage as your driving needs change

- No mileage tracking devices required, just simple odometer readings

Mile Auto’s pay-per-mile model is an attractive option for Yuma drivers who want to save money on car insurance without sacrificing coverage.

| Insurance Provider | Average Full Coverage Rate |

|---|---|

| Mile Auto | $84 per month |

| Certainly | $134.40 per month |

| Main Street America | $139.80 per month |

| Liberty Mutual | $163.80 per month |

“Mile Auto’s pay-per-mile insurance model is a game-changer for low-mileage drivers in Yuma, AZ. It allows us to save significantly on our car insurance without compromising coverage.”

For Yuma drivers seeking affordable and flexible mile auto car insurance options, Mile Auto’s pay-per-mile coverage is a great choice. Its pay-per-mile auto coverage options in Yuma and benefits of mile auto for low mileage drivers in Yuma make it a standout option for those driving less.

Specialty Coverage Options in Yuma

In Yuma, AZ, drivers can find many specialty car insurance options. These options are made for electric vehicle owners, classic car fans, and others. They ensure you get the right protection for your unique cars.

Insuring Electric Vehicles, Classic Cars, and More

Yuma Insurance, Inc. offers car insurance for electric vehicles in Yuma. These policies cover eco-friendly cars’ special needs. They include coverage for battery replacement and charging equipment. For insurance for classic cars in Yuma, they provide extra protection for vintage and antique cars, covering their true value.

Yuma drivers can also get specialty auto insurance in Yuma AZ for commercial fleets, high-performance sports cars, and more. These policies have options not found in regular auto insurance. They help owners protect their special cars.

- Electric vehicle insurance with coverage for battery and charging equipment

- Classic car insurance that protects vintage and antique vehicles

- Commercial fleet insurance for businesses with multiple vehicles

- Sports car insurance for high-performance automobiles

If you drive an eco-friendly electric car, a classic, or a sports model, check out Yuma’s specialty insurance. These policies offer the right coverage for your unique vehicle and needs.

Comparison Shopping for Affordable Car Insurance

Finding cheap car insurance in Yuma, Arizona means comparing quotes from different insurers. Your age, driving history, credit score, and ZIP code affect your rates. So, it’s important to shop around for the best deal.

To get the best deal on car insurance in Yuma, follow these steps:

- Gather information about your driving record, vehicle, and coverage needs.

- Compare auto insurance quotes in Yuma from at least 3-5 different providers.

- Look for discounts you may qualify for, such as good driver, safety features, or bundling policies.

- Adjust your coverage limits to find the right balance between cost and protection.

- Maintain a clean driving record to keep your how to find cheap car insurance in yuma az as low as possible.

| Insurer | Average Monthly Premium |

|---|---|

| Auto-Owners | $62 |

| State Farm | $77 |

| GEICO | $79 |

| Root | $83 |

| USAA | $86 |

By taking the time to compare car insurance quotes in Yuma, you can find affordable coverage that suits your needs and budget. With the right research and effort, you can drive with confidence and peace of mind in Yuma, AZ.

“Comparison shopping is the key to finding the most affordable car insurance in Yuma, AZ. Don’t just settle for the first quote you receive – explore your options to get the best deal.”

Conclusion

Car insurance is a must-have for all drivers in Yuma, AZ. With the right approach, you can find affordable coverage that fits your needs. By knowing the minimum coverage needed and comparing quotes from top insurers like DEE Auto Insurance, you can get reliable protection.

Whether you want basic liability or comprehensive coverage, it’s important to look at your options. Discounts for safe driving, bundling policies, and being a long-term customer can lower your premiums. This makes car insurance more affordable.

Remember these summary of car insurance in yuma az and key takeaways on finding the right auto coverage in yuma. With these tips, Yuma drivers can confidently navigate the insurance world. The right car insurance policy gives you peace of mind, covering accidents, theft, or other unexpected events.

Source Links

- AZ Auto & Home Insurance Quotes in Yuma | State Farm®

- 8 Best Yuma, AZ Local Car Insurance Agencies | Expertise.com

- Best Car Insurance in Yuma, AZ (2024) – Policygenius

- Yuma Auto Insurance

- Average car insurance cost in Arizona

- How Car Insurance Works In Arizona

- Best Car Insurance in Arizona (2024) | CarInsurance.org

- Average Cost of Car Insurance in Arizona in 2024 | Bankrate

- How Much Is Car Insurance in Yuma, AZ?

- Cheap Car Insurance Rates in Yuma, Arizona | SmartFinancial

2 Comments

Pingback: Car Insurance Yuma: Find Affordable Coverage Today

Pingback: Yuma Auto Insurance: Get Affordable Coverage Today