Scottsdale, Arizona, is a bustling city with a strong economy and a growing population. This means more people need reliable and affordable car insurance. If you’re a local or new to the area, finding the best car insurance can seem tough. But don’t worry, with the right info and advice, you can find the right coverage at a good price.

Key Takeaways

- The average cost of car insurance in Scottsdale is $141.82 per month, lower than the national average.

- Factors like age, driving record, and vehicle type can significantly impact car insurance rates in Scottsdale.

- Bundling auto and home insurance can save Scottsdale residents up to 40% on their premiums.

- Greene Insurance Group, a Trusted Choice Insurance Agent, has been providing competitive insurance rates in Scottsdale since 1962.

- Comparing quotes from multiple insurers is the best way to find the most affordable car insurance in Scottsdale.

What is the Average Cost of Car Insurance in Scottsdale?

Drivers in Scottsdale, Arizona, pay about $1,740 a year for full coverage car insurance on average. This is a bit more than Arizona’s average of $1,600 a year. Several factors play a big role in the cost of car insurance in Scottsdale.

Key Factors Affecting Rates

The main things that change car insurance costs in Scottsdale are:

- Age – Young and older drivers usually pay more than those in the middle age group.

- Driving Record – If you’ve had accidents, speeding tickets, or other violations, you’ll likely pay more.

- Credit History – Insurers look at your credit score to figure out your risk, so bad credit means higher premiums.

- Vehicle Type – The type of car you drive can change how much you pay for insurance.

- Zip Code – Where you live in Scottsdale can also change your insurance rates due to crime and accident rates.

To cut costs on car insurance in Scottsdale, drivers should shop around, look for discounts, and drive safely. Knowing what affects car insurance rates in Scottsdale helps drivers make smart choices to save on their car insurance in Scottsdale.

| Factor | Impact on Rates |

|---|---|

| Age | Younger and older drivers pay more |

| Driving Record | Accidents and violations lead to higher premiums |

| Credit History | Poor credit can result in higher insurance costs |

| Vehicle Type | Safer, less expensive vehicles tend to cost less to insure |

| Zip Code | Local factors like crime and accident rates affect premiums |

Cheapest Car Insurance Companies in Scottsdale

Looking for the cheapest car insurance in Scottsdale, Arizona? You have many great options. The cheapest car insurance companies in Scottsdale are:

- Root: $984 per year for full coverage

- Auto-Owners Insurance: $1,115 per year for full coverage

- GEICO: $1,126 per year for full coverage

These companies offer some of the most affordable car insurance options in Scottsdale. Their rates are lower than the city’s average of $1,740 for full coverage. Drivers should consider getting quotes from these providers for cheap car insurance in Scottsdale.

| Insurance Company | Average Annual Premium | J.D. Power Rating |

|---|---|---|

| Root | $984 | N/A |

| Auto-Owners Insurance | $1,115 | 865 |

| GEICO | $1,126 | 874 |

| State Farm | $1,338 | 882 |

| Travelers | $1,389 | 854 |

Car insurance rates in Scottsdale change a lot based on your driving history, credit score, and more. Always compare quotes from different top car insurance companies in Scottsdale. This way, you can find the most affordable car insurance options for you.

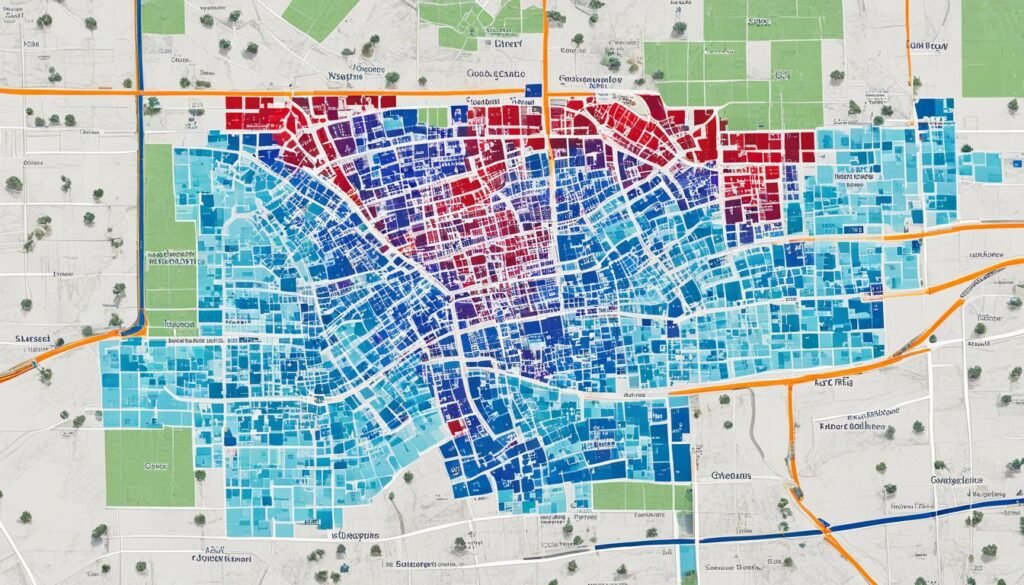

Car Insurance Scottsdale: Average Rates by ZIP Code

In Scottsdale, Arizona, car insurance rates vary a lot by ZIP code. Insurance companies look at risk factors in different areas to set premiums. Things like car theft, vandalism, accidents, and traffic violations affect car insurance rates by zip code scottsdale.

The average car insurance prices in different scottsdale neighborhoods range from $1,637 per year in the 85262 ZIP code to $1,793 per year in the 85250 ZIP code. Drivers in riskier areas pay more for their how location affects car insurance costs in scottsdale.

| ZIP Code | Average Annual Car Insurance Rate |

|---|---|

| 85262 | $1,637 |

| 85251 | $1,652 |

| 85260 | $1,665 |

| 85258 | $1,680 |

| 85250 | $1,793 |

Knowing how location affects car insurance costs in Scottsdale helps drivers make better choices. They can pick where to live and find affordable insurance.

Choosing the Right Car Insurance Provider

When looking for car insurance in Scottsdale, think about three main things: cost, coverage, and customer service. These factors help you pick the best insurance company for your needs and budget.

Cost

Begin by comparing quotes from different insurers to find the best price. Policygenius can help Scottsdale drivers compare policies and find the right one for them. Remember, the cheapest option might not always offer the best coverage. Aim for a balance between cost and protection.

Coverage

Look closely at the coverage options to make sure you’re well-protected. In Scottsdale, you must have at least $25,000 for bodily injury per person, $50,000 for per accident, and $15,000 for property damage. But, you might want more coverage, like collision, comprehensive, or personal injury protection, based on your needs.

Customer Service

Check the customer service and claims satisfaction ratings to ensure a good experience if you need to file a claim. Choose providers known for quick and efficient claims handling. Also, look for flexible payment options and easy-to-use online portals.

By looking at cost, coverage, and customer service, you can find the best car insurance in Scottsdale. This way, you’ll protect your vehicle and have peace of mind while driving.

Car Insurance Rates for High-Risk Drivers

Drivers in Scottsdale, Arizona with a history of traffic violations or poor credit may find it hard to get affordable car insurance. But, by shopping around and looking at different insurers, they can find coverage that meets their needs and budget.

Driving Infractions and Credit Impacts

Insurance data shows that drivers with a DUI in Scottsdale pay about $1,039 a year for the cheapest full coverage from Root Insurance Company. Those with a speeding ticket pay a bit more, but still get the best deal at $1,144 annually from Root.

Drivers with poor credit in Scottsdale also pay more for car insurance. Root offers the cheapest full coverage at around $1,202 a year. High-risk drivers should look at quotes from several insurers to find the cheapest car insurance options for high-risk drivers in Scottsdale.

“Factors like driving infractions and credit history can significantly impact car insurance rates for high-risk drivers in Scottsdale. However, shopping around and exploring options from different insurers can help find the most car insurance for high-risk drivers in Scottsdale.”

Car Insurance Scottsdale: Minimum Coverage Requirements

If you drive in Scottsdale, Arizona, knowing the state’s car insurance rules is key. Arizona law says all drivers must have a certain amount of insurance. This includes $25,000 for bodily injury to one person, $50,000 for an accident, and $15,000 for property damage.

This is the basic insurance you need in Scottsdale. Not having this insurance can lead to losing your driver’s license and vehicle registration.

Arizona also requires Medical Payments (MedPay) coverage, with at least $3,000. You can choose not to have this coverage, but it’s often a good idea to keep it.

While the 25/50/15 coverage is the legal minimum, many Scottsdale drivers choose more coverage. This is to make sure they’re well-protected if they’re in an accident. It’s also smart to think about Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage. These can help if you’re hit by someone with little insurance.

| Coverage Type | Minimum Required in Scottsdale |

|---|---|

| Bodily Injury Liability | $25,000 per person, $50,000 per accident |

| Property Damage Liability | $15,000 per accident |

| Medical Payments (MedPay) | $3,000 (can be waived in writing) |

These are the basics in Scottsdale, but it’s wise to think about more coverage. This way, you’ll be fully protected on the road.

Cheapest Full Coverage Car Insurance in Scottsdale

Finding the cheapest full coverage car insurance in Scottsdale is key for your vehicle’s safety. Root Insurance Company is the top choice, offering full coverage for $756 a year. They are the best for drivers looking for great protection without spending too much.

GEICO is another great option, with full coverage costing about $869 yearly. These two companies are the best deals for drivers wanting full protection against accidents and theft, no matter who is at fault.

When to Consider Full Coverage

Full coverage is a good idea for drivers with new or financed cars. It covers accidents and other incidents, even if you’re to blame. But, for older cars, the extra cost might not be worth it.

Think about your car’s age, value, and any loans or leases you have before choosing full coverage in Scottsdale. Weighing the pros and cons helps you pick the right coverage that fits your budget and needs.

| Insurance Company | Average Annual Premium for Full Coverage |

|---|---|

| Root Insurance Company | $756 |

| GEICO | $869 |

| Auto-Owners Insurance | $1,115 |

| State Farm | $1,338 |

| Travelers | $1,389 |

Looking at the cheapest full coverage car insurance in Scottsdale helps you make a smart choice. It ensures your driving needs and budget are met.

Car Insurance Scottsdale: After a Driving Offense

Drivers in Scottsdale with a history of traffic violations will see their car insurance rates go up. The cheapest car insurance option for Scottsdale drivers with a speeding ticket is Root Insurance Company, with an annual premium of $929. For those with an at-fault accident, Root offers the most affordable full coverage at $949 per year. For a DUI, Root provides the lowest rate at $836 annually. CSAA has the highest rates for these driving offenses, showing the need to shop around for the best deal.

The impact of driving infractions on car insurance costs in Scottsdale can be big. A DUI in Arizona can increase insurance premiums by $300 to $800 a year. Age, gender, and marital status can also affect how much premiums go up.

Drivers with violations can lower their insurance costs. Keeping a clean driving record and taking defensive driving courses can help. If a DUI charge is dropped from your criminal record, it can lessen the premium increase.

| Insurance Provider | Speeding Ticket | At-Fault Accident | DUI |

|---|---|---|---|

| Root Insurance Company | $929 | $949 | $836 |

| CSAA | Highest Rates | Highest Rates | Highest Rates |

Understanding the cheapest car insurance for drivers with violations in Scottsdale helps drivers make smart choices. They can take steps to lessen the financial hit from a driving offense.

Insuring Teenage Drivers in Scottsdale

Getting car insurance for teen drivers can be tough for parents. But, it’s key for their safety and financial well-being. In Arizona, teens can get a learner’s permit at 15 and a half and a full license between 16 and 18.

When insuring a teen driver in scottsdale, rates change based on the teen’s age, gender, driving history, grades, and family insurance history. Adding all teens to one policy can lower rates and risks.

Factors Affecting Teen Driver Rates

MoneyGeek says Travelers offers the cheapest full coverage for Scottsdale teens, costing $1,723 for girls and $2,057 for boys on a family policy. GEICO is close behind, charging $2,413 for both girls and boys.

Arizona’s new insurance rules also affect rates. Now, insurance must cover at least $25,000 for one person’s injuries, $50,000 for more, and $15,000 for property damage.

| Insurance Provider | Annual Premium for Female Teens | Annual Premium for Male Teens |

|---|---|---|

| Travelers | $1,723 | $2,057 |

| GEICO | $2,413 | $2,413 |

To get the best rates, parents should look for discounts for good grades and safety courses. These can help lower the cost of insuring teen drivers.

“Instilling safe driving habits in teen drivers through limiting passengers, driving times, and emphasizing the dangers of drinking, texting, and driving is crucial.”

Tips for Finding Affordable Car Insurance Rates

Scottsdale drivers can find cheaper car insurance by driving safely and keeping a clean record. This avoids premium increases and makes you eligible for discounts. Always drive carefully to keep your rates low.

Shopping around and comparing quotes is another smart move. This helps you find the best deal and use discounts for things like being a good student or driving less. Look for insurers that offer these discounts.

- Maintain a clean driving record

- Shop around and compare quotes from multiple insurers

- Take advantage of available discounts

- Consider increasing your deductibles to lower monthly premiums

Increasing your deductibles can also lower your insurance costs. But make sure you can afford the higher costs if you need to make a claim. By using these tips, Scottsdale drivers can get affordable insurance that meets their needs.

| Insurance Provider | Liability-Only Coverage | Full Coverage |

|---|---|---|

| Auto-Owners | $48 per month | $81 per month |

| Mile Auto | $51 per month | $84 per month |

| USAA | $66 per month | $112 per month |

Insurify’s data shows Auto-Owners, Mile Auto, and USAA are the cheapest for Scottsdale drivers. Auto-Owners and Mile Auto have great rates, and USAA is best for the military community.

“Insurify’s IQ Score objectively rates insurance companies on a scale of one to ten, considering criteria such as financial ratings, customer satisfaction, affordability, customer support, and transparency.”

By following these tips for finding affordable car insurance in scottsdale, drivers can get the best rates and coverage for their needs and budget.

car insurance scottsdale: Shopping Around for the Best Rates

To find the most affordable car insurance in Scottsdale, it’s key to shop around and compare quotes from many providers. Rates can change a lot, even for the same coverage, so taking time to get quotes from several insurers can save you a lot of money. Things like your age, driving record, credit history, and the vehicle you drive affect your car insurance rates.

Websites like Policygenius make comparing quotes easy and help you find the best coverage at a low cost. Our research shows Auto-Owners is the top insurer in Arizona with a score of 3.92 out of 5 stars. They offer an average yearly premium of $1,539, or $128 per month, which is about $273 less than the state average.

Other top providers in Scottsdale include Travelers and Geico, known for their competitive rates and reliable service. Geico is the cheapest car insurance option in Arizona, with an average premium of $1,312 per year. On the other hand, Farmers is the most expensive insurer, charging an average premium of $2,331 per year.

| Insurance Provider | Average Yearly Premium | Monthly Premium |

|---|---|---|

| Auto-Owners | $1,539 | $128 |

| Travelers | $1,389 | $116 |

| Geico | $1,312 | $109 |

| Farmers | $2,331 | $194 |

Remember, your driving record, credit score, age, and location can all affect your car insurance rates. To get the best car insurance rates in Scottsdale, it’s important to compare car insurance quotes from different providers and look for discounts. By shopping for car insurance in Scottsdale, you can make sure you’re getting the right coverage at a good price.

“Comparing car insurance quotes and shopping around is the best way to find the most affordable coverage in Scottsdale.”

Conclusion

Car insurance in Scottsdale can be pricier than the Arizona average, with full coverage costing about $1,740 yearly. Yet, drivers can find affordable options by shopping around and using discounts. A clean driving record also helps.

The cheapest options in Scottsdale are Root, Auto-Owners Insurance, and GEICO. But rates change a lot based on your own factors.

To get the best rates, Scottsdale residents should know the minimum coverage needed. They should also consider full coverage and insure teenage drivers right. Key tips include researching well, using discounts, and driving safely.

Getting the best car insurance rates in Scottsdale means staying updated on local laws. It also means looking at different providers and making smart choices. With the right knowledge, drivers can find a good and affordable solution for their needs.

Source Links

- Scottsdale Car Insurance | Auto, Home, Life & Business | Greene Insurance Group

- Cheap Car Insurance Rates in Scottsdale, Arizona | SmartFinancial

- Best Cheap Car Insurance in Scottsdale, AZ, Starting at $48

- How Much Is Car Insurance in Arizona? (August 2024)

- Arizona Car Insurance: Get a Quote

- Best Car Insurance in Scottsdale, AZ (2024) – Policygenius

- Cheapest and Best Car Insurance in Scottsdale, AZ (July 2024)

- Auto & Home Insurance in Scottsdale, AZ | State Farm®

- Average car insurance cost in Scottsdale, AZ [From $143 a month]

- Scottsdale, AZ Car Insurance

- Average Cost of Car Insurance in Arizona in 2024 | Bankrate