If you live in Yuma, Arizona and are looking for affordable car insurance, you’re in luck. The average cost of full coverage auto insurance here is $1,431 per year. This is about 2% higher than the national average. But, with the right insurer and coverage options, you can find rates that fit your budget.

The cheapest car insurance company in Yuma is Root. They offer full coverage policies starting at $816 per year on average. Auto-Owners Insurance is another top choice, with an average annual rate of $911 for full coverage. These options, along with discounts and cost-saving strategies, can help Yuma drivers get affordable car insurance that meets their needs.

Key Takeaways

- The average cost of full coverage auto insurance in Yuma, AZ is $1,431 per year.

- Root and Auto-Owners Insurance offer the cheapest full coverage rates in Yuma, starting at $816 and $911 per year, respectively.

- Yuma drivers can find affordable auto insurance yuma az options that are only slightly higher than the national average.

- Exploring discounts and cost-saving strategies can help Yuma residents secure the best deals on cheapest car insurance in yuma.

- Researching and comparing best car insurance companies in yuma is crucial to finding the right coverage at the right price.

Understanding Auto Insurance Rates in Yuma

Car insurance in Yuma, Arizona is affected by many factors. Your age, driving history, and the car you drive all play a part in setting your insurance costs. Insurers look at this data to figure out how much coverage will cost you.

Factors Affecting Car Insurance Costs

Your personal details greatly influence your car insurance rates in Yuma. If you have a clean driving record, good credit, and a newer car, you’ll likely pay less. Where you live in the city also matters. Insurers use accident and crime data for specific ZIP codes to set prices.

- Age: Young drivers, especially those under 25, often pay more because they have less experience.

- Driving History: A history of accidents or tickets means higher insurance costs.

- Credit Score: Insurers use credit scores to assess risk, and lower scores can lead to higher rates.

- Vehicle Type: The type of car you drive affects your insurance costs. Newer, pricier cars usually cost more to insure.

Average Rates for Full Coverage in Yuma

Policygenius reports that the average yearly cost for full coverage car insurance in Yuma is $1,431. This breaks down to $119 monthly. It includes liability, collision, comprehensive, and other optional coverages. But, rates can change a lot based on your specific situation.

“By comparing quotes, drivers in Yuma can save up to $2,626 on average.”

Remember, these are just averages. Your actual car insurance costs in Yuma could be more or less, depending on your unique situation. To get the best deal, it’s smart to shop around and compare quotes from different insurers.

Cheapest Car Insurance Companies in Yuma

Finding the lowest car insurance rates in Yuma is key for drivers wanting to save money. The best car insurance providers in Yuma for affordable rates are:

- Root – $816 per year for full coverage

- Auto-Owners Insurance – $911 per year for full coverage

- GEICO – $1,045 per year for full coverage

- Travelers – $1,150 per year for full coverage

- USAA – $1,161 per year for full coverage

These companies offer the lowest car insurance rates in Yuma, AZ. But, it’s important for drivers to compare quotes and coverage to find what fits their needs and budget. Things like your driving history, the type of car you drive, and where you live can change how much you pay for insurance. So, it’s smart to shop around to get the best rate.

“Comparing quotes from multiple insurers is the best way to find the most budget-friendly auto coverage in Yuma.”

Exploring Affordable Alternatives

Yuma drivers can also look at midsize insurers like Auto-Owners and USAA for affordable options. These companies offer competitive rates and a variety of coverage choices. This can help Yuma residents find the right policy for their needs.

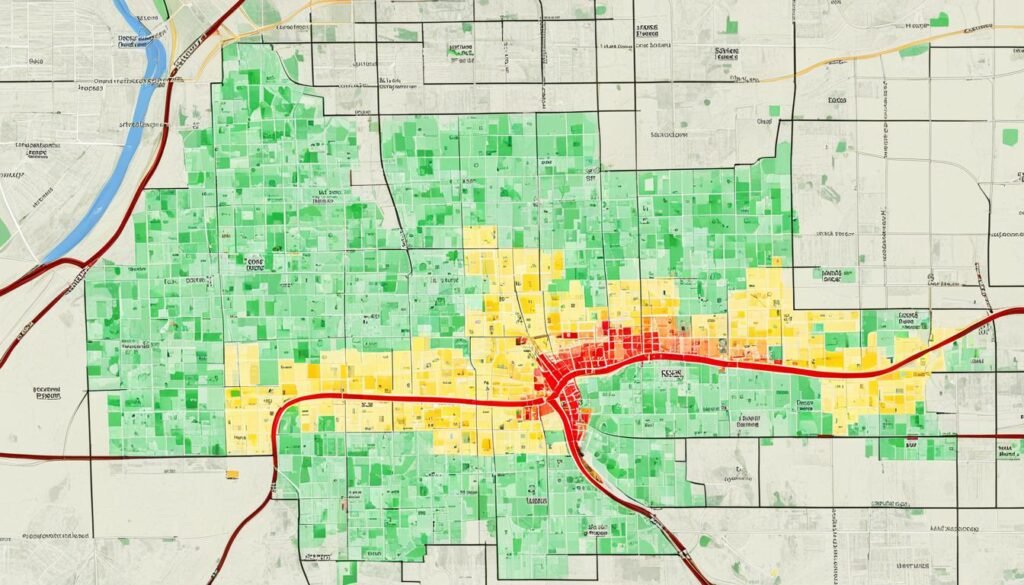

auto insurance yuma az: Comparing ZIP Code Rates

In Yuma, Arizona, auto insurance rates change a lot based on your ZIP code. The cheapest rates are in ZIP code 85365, costing about $1,424 a year for full coverage. The priciest rates are in ZIP code 85364, at $1,438 a year.

How Location Impacts Premiums

Why do rates differ so much? It’s because of accidents, crime, and parking in each area of Yuma. Places with more accidents or thefts have higher insurance costs. But, areas with good parking and low crime have lower rates.

| ZIP Code | Average Full Coverage Rate |

|---|---|

| 85365 | $1,424 |

| 85364 | $1,438 |

Yuma drivers should know how their location affects their insurance costs. By looking into rates by ZIP code, they can make better choices and save money.

“The demographics, driving record, and location of drivers in Yuma impact their car insurance premiums, with rates varying between ZIP codes in Yuma.”

Choosing the Right Insurer for Your Needs

When picking the best car insurance, look beyond just the price. In Yuma, drivers should check the coverage, customer service, and financial strength of insurers. This helps in finding the right policy for your needs and budget.

Combining home, auto, and other policies can lead to big discounts. This strategy helps Yuma residents find a policy that fits their budget and needs. By considering these factors, you can make a smart choice and get the right protection.

Key Considerations for Yuma Drivers

- Coverage options beyond the minimum liability requirements

- Insurer’s customer service ratings and claims handling

- Financial stability and claims-paying ability of the provider

- Potential savings through bundling home, auto, and other policies

| Insurance Provider | Coverage Options | Customer Satisfaction | Financial Strength |

|---|---|---|---|

| State Farm | Comprehensive, collision, liability, and more | High customer satisfaction ratings | Excellent financial stability and claims-paying ability |

| Geico | Liability, comprehensive, collision, and specialty coverages | Generally positive customer reviews | Strong financial ratings and claims-paying history |

| Allstate | Wide range of coverage options, including accident forgiveness | Mixed customer satisfaction reports | Solid financial standing and claims-paying reputation |

By looking at these factors, Yuma drivers can pick the right car insurance provider. It’s important to explore options and choose a reputable insurer. This ensures you’re well-protected on Yuma’s roads.

Driving Violations and Their Impact on Rates

In Yuma, Arizona, your driving history greatly affects your car insurance rates. If you have speeding tickets, at-fault accidents, or DUI convictions, you’ll pay more for insurance. Those with clean records pay less.

DUI Convictions and Insurance Costs

Root offers the cheapest car insurance for Yuma drivers with a DUI at $870 a year. For speeding tickets, Root is still the best choice at $955 a year. But, serious infractions can make rates more than double for drivers with perfect records.

| Violation | Average Annual Premium |

|---|---|

| DUI Conviction | $870 (Root Insurance) |

| Speeding Ticket | $955 (Root Insurance) |

| Clean Driving Record | $450 (Average) |

Driving violations greatly affect how traffic tickets affect car insurance in yuma and dui insurance rates in yuma az. Insurers see these infractions as signs of higher risk. This leads to much higher premiums for drivers with them.

“Driving with a DUI conviction can more than double your car insurance costs in Yuma. It’s crucial to maintain a clean record to qualify for the best rates.”

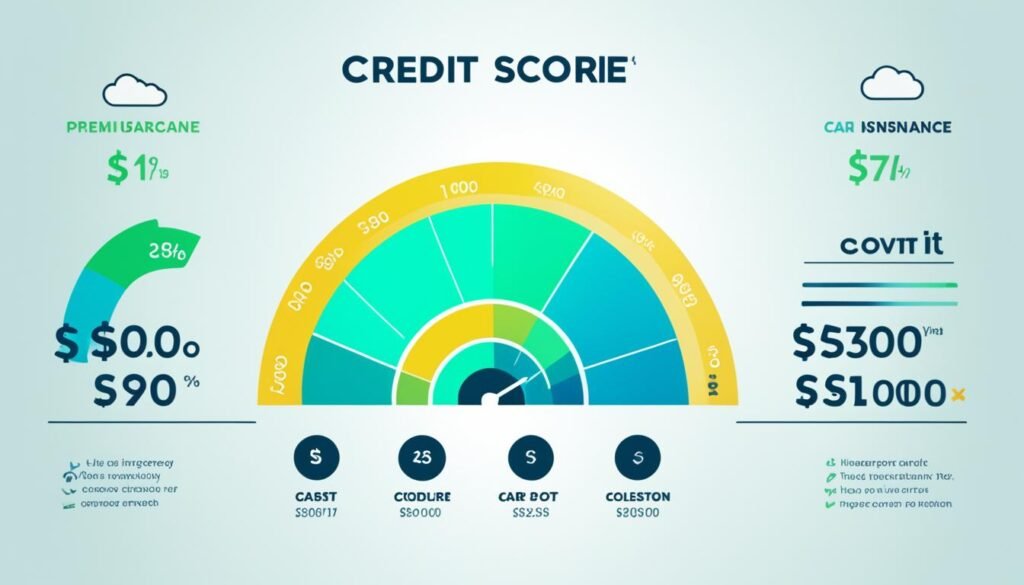

The Role of Credit Score in Car Insurance Pricing

Your credit score is key in setting your car insurance rates in Yuma, Arizona. Insurance companies use credit scores to see how risky you are as a driver. Drivers with poor credit scores often pay much more for their car insurance.

For Yuma drivers with bad credit, the best deal is usually Root, costing about $1,008 a year. Other good choices include GEICO ($1,480 a year) and Safeway Insurance ($1,596 a year).

Keeping a good credit score is vital for lower car insurance costs in Yuma. About 95% of personal insurance companies look at credit scores to set rates. Improving your credit can lead to big savings on your auto insurance.

| Insurance Company | Average Annual Rate (Bad Credit) |

|---|---|

| Root | $1,008 |

| GEICO | $1,480 |

| Safeway Insurance | $1,596 |

Your credit score greatly affects your car insurance rates in Yuma. By improving your credit, you could save hundreds on your yearly auto insurance.

Meeting Arizona’s Minimum Coverage Requirements

In Arizona, all drivers must have a certain level of car insurance. This includes $25,000 per person/$50,000 per accident in bodily injury liability coverage and $15,000 in property damage liability coverage. This basic coverage is called the state’s “minimum coverage” and helps protect drivers financially if they cause an accident.

Experts suggest getting higher liability limits and coverages like collision and comprehensive. Arizona is an at-fault state. This means the insurance of the driver at fault pays for the damages.

Liability Limits and At-Fault Rules

To meet Arizona’s car insurance needs, drivers must have at least:

- $25,000 per person/$50,000 per accident in bodily injury liability coverage

- $15,000 in property damage liability coverage

Arizona also requires uninsured and underinsured motorist coverage with the same limits as liability coverage. This protects drivers if they hit someone with no or not enough insurance.

Arizona’s at-fault laws mean the responsible driver’s insurance pays for damages. This includes medical bills and fixing property. It’s important to have enough liability coverage to protect your finances after a crash.

“Carrying the minimum required car insurance coverage in Arizona is essential, but higher limits and additional protections are often recommended to fully safeguard your financial wellbeing.”

Tips for Finding Affordable Car Insurance

If you live in Yuma, Arizona, you can use several strategies to get cheaper car insurance. Comparing quotes from different providers is just the start. There are discounts and ways to save that can lower your premiums.

Discounts and Cost-Saving Strategies

One great way to save on car insurance in Yuma is to use discounts. Many companies give discounts if you bundle your auto policy with other insurance, like homeowners or renters insurance. Keeping a clean driving record and good credit can also get you lower rates. Plus, taking a defensive driving course can lead to big savings.

Consider lowering your coverage on older cars or upping your deductibles. This might mean paying more if you need to make a claim, but it can cut down your insurance costs. Shopping around and comparing quotes often helps Yuma residents find the best rates for their needs.

Using these strategies, Yuma drivers can find cheap car insurance and cut down on their auto insurance costs.

“Prioritizing affordability without sacrificing comprehensive coverage is key to finding the right auto insurance solution in Yuma, Arizona.”

Getting affordable car insurance in Yuma means being proactive. Know what affects rates, use discounts, and compare quotes often. This way, Yuma residents can make sure they’re getting good value for their insurance money.

Insuring Specialty Vehicles in Yuma

In Yuma, many people own special vehicles like RVs, ATVs, and classic cars. These vehicles need special insurance that’s different from regular car insurance. Car insurance for specialty vehicles in Yuma helps protect these valuable items.

Things like your driving record and past claims can affect how much you pay for insurance. Some ATVs and off-road vehicles are seen as riskier and cost more to insure. But, if you have more than one special vehicle, you might get a discount.

Insurance policies for ATVs, snowmobiles, and other off-road vehicles usually include several types of coverage. These include collision, property damage, bodily injury, and comprehensive coverage. Insuring RVs, ATVs, and other specialty rides in Yuma means understanding these coverages well.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Protects against damage to your specialty vehicle in the event of a collision. |

| Liability Coverage | Covers property damage and bodily injury to others if you’re found at-fault in an accident. |

| Comprehensive Coverage | Protects against non-collision damage, such as theft, vandalism, or natural disasters. |

“Specialty vehicle owners in Yuma need to consider the unique coverage requirements and potential risks associated with their prized assets. Working with an experienced insurance provider can help ensure proper protection.”

Fontanes Insurance Group LLC is a local agency that specializes in car insurance for specialty vehicles in Yuma, Arizona. They offer customized policies for motorcycles, RVs, and other unique vehicles. By working with Nationwide, they can meet the specific needs of Yuma’s specialty vehicle owners.

The Importance of Shopping Around

Finding the best car insurance rates in Yuma, AZ means comparing quotes from different providers. Auto insurance prices can change a lot between companies. By shopping around, you can find affordable coverage that fits your needs.

In Arizona, the average cost for full coverage auto insurance is $2,585 a year. This is close to the national average. But, for minimum coverage, the average rate is $764 a year, which is 21% higher than the national average. This shows why it’s important to compare car insurance quotes in Yuma to find the best deal.

Companies like Geico, State Farm, Progressive, Travelers, and Nationwide are great choices for Arizona drivers. For example, Progressive got a rating of 4.4 stars out of 5 in customer satisfaction. This makes it a top pick for many in Yuma.

“Taking the time to compare multiple car insurance quotes can save Yuma drivers hundreds of dollars per year on their premiums.”

Websites like Policygenius let you easily compare car insurance rates in Yuma, AZ from top providers. Just enter your zip code and some personal info. You’ll see personalized quotes and find the best coverage at affordable rates.

Don’t just take the first quote you get. Shopping around and comparing car insurance quotes in Yuma is the best way to make sure you’re getting the best car insurance rates in Yuma, AZ.

Top Car Insurance Providers for Yuma Drivers

Looking for the best car insurance in Yuma, Arizona? You have many top options to choose from. These companies stand out for their coverage, cost, and customer service. Here are some of the best auto insurers in Yuma:

Geico

Geico is known for its affordable car insurance in Yuma. On average, Yuma drivers pay $518 a year for the basic coverage and $1,466 for full coverage. Geico is loved for its easy-to-use app, many discounts, and quick claims service.

State Farm

State Farm is a big name in auto insurance, especially in Yuma. It’s known for its local agents, personalized service, and many coverage options. In Yuma, State Farm’s full coverage costs about $3,000 a year.

Allstate

Allstate is a top pick for Yuma drivers looking for reliable and affordable insurance. It offers unique features like Drivewise, a program that can lower your premiums if you drive safely. Allstate’s full coverage in Yuma costs around $3,200 a year.

| Insurance Provider | Average Annual Cost for Minimum Liability Coverage | Average Annual Cost for Full Coverage | Customer Satisfaction Rating (out of 5) |

|---|---|---|---|

| Geico | $518 | $1,466 | 4.2 |

| State Farm | $650 | $3,000 | 4.5 |

| Allstate | $680 | $3,200 | 4.0 |

When picking the best car insurance companies in Yuma AZ, think about coverage, cost, and customer service. By comparing and shopping around, Yuma drivers can find the top rated auto insurers that suit their needs and budget.

Conclusion

Finding cheap car insurance in Yuma, Arizona means looking at many factors. The average cost for full coverage is $1,431 a year. But, rates change a lot based on your age, driving record, credit score, and where you live. By shopping around and using discounts, Yuma residents can get good coverage at a great price.

Top insurers like Auto-Owners, Mile Auto, and State Farm offer different benefits for different drivers. They have options for liability, collision, and comprehensive coverage. These providers can help you find a policy that fits your needs and budget. Knowing what affects car insurance rates in Yuma, AZ, and making smart choices can help you get the best value for your money.

This article gives you tips to confidently find the right car insurance in Yuma. The summary and key takeaways can guide you to make smart choices. They help you protect yourself and your vehicle on the roads.

Source Links

- 8 Best Yuma, AZ Local Car Insurance Agencies | Expertise.com

- AZ Auto & Home Insurance Quotes in Yuma | State Farm®

- Yuma, AZ Car Insurance

- How Much Is Car Insurance in Yuma, AZ?

- Best Car Insurance in Yuma, AZ (2024) – Policygenius

- Cheap Car Insurance Rates in Yuma, Arizona | SmartFinancial

- Cheap Car Insurance in Yuma, AZ, Starting at $39

- Cheapest car insurance in Yuma, Arizona (Aug 2024)

- Get a Quote For Auto Insurance In Yuma, Arizona

- Yuma Insurance, Inc., Yuma – 85364 – Nationwide

1 Comment

Pingback: Car Insurance Yuma: Find Affordable Coverage Today