If you drive in Lynchburg, Virginia, you can get affordable car insurance by comparing quotes from different companies. On average, drivers in Lynchburg pay about $107.27 a month for insurance. This is less than the national average of $167.23 a month.

To get the best rates, it’s important to know what affects insurance costs. This includes your driving and claims history, and where you live in Lynchburg.

Key Takeaways

- Lynchburg drivers pay around $107.27 per month for car insurance, lower than the national average.

- Shopping around and comparing quotes from multiple insurers is the best way to find affordable Lynchburg vehicle insurance.

- Factors like driving history, claims history, and location within Lynchburg can impact the cost of coverage.

- The most affordable car insurance companies in Lynchburg include Mercury Insurance, Utica National Ins Group, and State Farm.

- Rates in Lynchburg can vary significantly across different ZIP codes.

Average Car Insurance Rates in Lynchburg

In Virginia, Lynchburg has some of the most affordable average auto insurance rates. The average cost for car insurance in Lynchburg VA is about $107.27 per month. This is lower than both the state and national averages.

Many things can affect how much you pay for car insurance in Lynchburg. These include your driving record, age, and the car you own. But Lynchburg tends to have lower rates than many other places in Virginia. This makes it a good choice for those looking for affordable insurance.

| Location | Average Monthly Rate | Average Annual Rate |

|---|---|---|

| Lynchburg, VA | $107.27 | $1,287.24 |

| Virginia State Average | $122.24 | $1,466.88 |

| National Average | $167.23 | $2,006.76 |

Knowing the average auto insurance rates in Lynchburg helps drivers make better choices. They can compare these rates to the state and national averages. This way, they can save money on their car insurance.

Top Insurers for Affordable Lynchburg Auto Insurance

Looking for the least expensive car insurance in Lynchburg means comparing quotes from many providers. Our research shows the cheapest auto insurance providers in Lynchburg are:

- Mercury Insurance: $65.65/month

- Utica National Ins Group: $78.51/month

- State Farm: $80.19/month

These most affordable insurance companies in Lynchburg offer rates well below the city average of $107.27 per month. Other great options include USAA, Clearcover, Auto-Owners Insurance Co, and Penn National.

“I was able to save over $500 a year on my auto insurance by switching to one of the more affordable providers in Lynchburg. The process was quick and easy, and the coverage has been excellent.”

Shopping around is key to finding the best car insurance deal in Lynchburg, Virginia. By comparing quotes from various providers, you can make sure you’re getting the best rates for your needs.

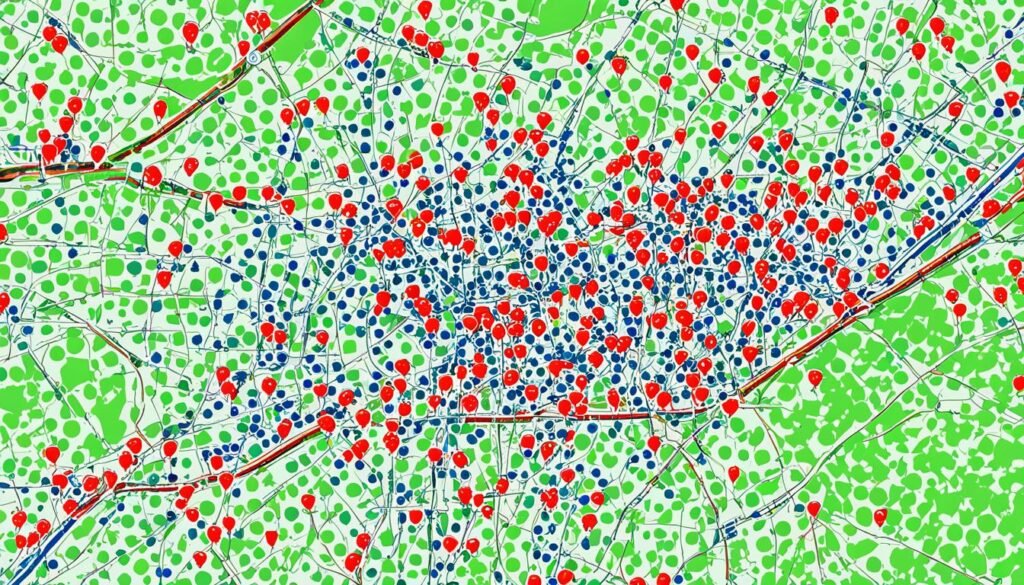

How Location Impacts Rates

Your location in Lynchburg affects your car insurance rates. The data shows that rates change a lot across different zip codes. Crime rates, traffic, and accidents in your area can raise your insurance costs.

Lynchburg Zip Code Rates

For instance, drivers in the 24515 zip code pay about $267.92 a month. Those in the 24522 zip code pay only $34.45 a month. This shows how much car insurance rates by zip code in lynchburg can vary.

To understand how location affects auto premiums in lynchburg, look into what affects rates in your area. Knowing your neighborhood’s unique traits helps you find cheaper insurance.

“The exact cost of insurance can vary based on individual circumstances, such as age, driving record, credit tier, and type of vehicle.”

Age and Car Insurance Costs

In Lynchburg, the cost of auto insurance depends a lot on the driver’s age. Younger drivers usually pay more for their insurance than older drivers.

Teenagers, aged 16-19, pay the highest average monthly rate of $302.36. This is because they have less driving experience and are seen as higher risk. But, they can get discounts for safe driving and good grades.

As drivers get older, their insurance rates go down. Those in their 20s pay about $166.46 a month. Drivers in their 30s pay $88.82, and those in their 40s pay $96.19 on average.

| Age Group | Average Monthly Rate |

|---|---|

| 16-19 years old | $302.36 |

| 20s | $166.46 |

| 30s | $88.82 |

| 40s | $96.19 |

| 60s | $92.03 |

| 70+ | $85.53 |

For drivers 60 and older, rates start to go up again. Those in their 60s pay $92.03, and those 70 and up pay $85.53 on average. This is because older drivers may face more health issues and vision problems.

In summary, how age affects auto insurance prices in Lynchburg is important for drivers looking for affordable insurance. Knowing how age impacts car insurance costs helps Lynchburg residents find the cheapest insurance for different age groups and car insurance rates by driver age in Lynchburg.

Insurance for Teen Drivers

Teenagers in Lynchburg face high car insurance rates. They pay about $302.36 each month on average. Yet, some insurers offer cheaper options for these young drivers.

Most Affordable for Teens

Erie is often the cheapest, costing around $188.18 a month for teens in Lynchburg. State Farm and USAA are also good choices for car insurance for teenage drivers in lynchburg.

- Erie: $188.18 per month

- State Farm: $207.89 per month

- USAA: $212.74 per month

When looking for the best insurance companies for young drivers in lynchburg, compare quotes from different providers. Your driving history, credit score, and the type of car you drive affect your rates.

“Finding affordable car insurance as a teen driver in Lynchburg can be a challenge, but with the right research and comparison, it’s definitely possible to get quality coverage at a reasonable price.”

Insurance for Young Drivers in Their 20s

For young drivers in their 20s, finding affordable car insurance in Lynchburg can be tough. But, there are ways to save. The average monthly cost for 20-year-old drivers in Lynchburg is $166.46. This is lower than what teenage drivers pay.

Some of the top insurers offering the cheapest auto policies for young adults in Lynchburg include:

- Utica National Ins Group ($90.33/month)

- Mercury Insurance ($109.08/month)

- State Farm ($111.02/month)

Other best car insurance for 20 year olds in Lynchburg providers to think about are USAA and Chubb. By looking around and using discounts, young drivers can cut costs on their auto insurance in Lynchburg.

| Insurance Provider | Average Monthly Rate for 20-Year-Olds |

|---|---|

| Utica National Ins Group | $90.33 |

| Mercury Insurance | $109.08 |

| State Farm | $111.02 |

| USAA | $115.44 |

| Chubb | $123.16 |

“By taking advantage of available discounts and shopping around, young drivers in their 20s can find ways to save on auto insurance in Lynchburg.”

Most Affordable for Drivers in Their 30s

Drivers in their 30s often find affordable car insurance rates in Lynchburg. The average monthly cost for 30-year-olds is about $88.82. Some top insurance providers offer great deals for 30-year-olds:

- State Farm: $65.71/month

- Utica National Ins Group: $73.30/month

- Mercury Insurance: $73.33/month

Drivers in their 30s should also look at Direct Auto and USAA for insurance. These companies offer discounts for good driving, credit, and bundling policies. This makes them great for 30-year-olds looking for affordable coverage.

“Finding affordable car insurance as a 30-year-old in Lynchburg is definitely achievable. The key is shopping around and maximizing available discounts.”

If you’re new or long-time in Lynchburg, it’s smart to check out your insurance options. This way, you can find the best policies for 30-somethings without spending too much. With the right provider and coverage, drivers in their 30s can get reliable protection at a good price.

Minimum Coverage Requirements in Virginia

In Virginia, all drivers must have a certain amount of auto insurance. This includes at least $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident. You also need uninsured motorist coverage with the same limits.

Some drivers might think they can skip insurance by paying a $500 fee to the DMV. But, this is actually illegal and can lead to fines up to $500. The legal liability limits for drivers in Lynchburg and Virginia make sure everyone is responsible after an accident.

In 2015, there were 125,800 crashes, 20,768 DUI convictions, and 753 fatalities in Virginia. These numbers show why virginia minimum auto insurance requirements are important. They help protect drivers and pedestrians.

| Minimum Coverage Limits | Current Requirement | Requirement Starting 2025 |

|---|---|---|

| Bodily Injury per Person | $25,000 | $50,000 |

| Bodily Injury per Accident | $50,000 | $100,000 |

| Property Damage per Accident | $25,000 | $25,000 |

Starting in 2025, insurance coverage will increase. This means more money could be available for people hurt in car accidents. This change will affect many cases where insurance is not enough or there is none.

“Leaving children unattended in vehicles in Virginia, even for short periods, is prohibited, and can result in charges against the responsible adult.”

As laws change, it’s important for Lynchburg drivers to know their insurance needs. They should make sure they have the right coverage to protect everyone on the road.

Lynchburg Auto Insurance: Get Affordable Coverage

Finding cheap car insurance in Lynchburg, Virginia is easier than you think. By using discounts and comparing prices, drivers can find great deals on auto insurance. Here are some tips to help Lynchburg residents get the most affordable coverage:

- Compare quotes from different companies: Rates can change a lot between providers. It’s important to compare quotes from different companies to find the cheapest car insurance in Lynchburg.

- Use available discounts: Lynchburg drivers can save money by getting discounts for being good drivers or having safe cars. They can also save by bundling home and auto policies.

- Keep a clean driving record: Your driving history affects your rates. Keeping a spotless record is key to finding the best deals on Lynchburg auto insurance.

- Consider usage-based insurance: Programs like Pay As You Drive can give Lynchburg residents big savings if they drive less.

By using these tips, Lynchburg drivers can find cheap car insurance in Lynchburg and get the coverage they need at a good price. With some research and effort, getting the best deals on Lynchburg auto insurance is possible.

| Insurer | Average Monthly Premium |

|---|---|

| Mercury Insurance | $87 |

| Utica National Ins Group | $92 |

| State Farm | $98 |

The data shows that drivers in Lynchburg can save money by looking at these top insurers. They offer some of the cheapest average monthly rates in the area.

“By understanding the local market and their own coverage needs, Lynchburg drivers can find the right policy at the right price.”

Conclusion

Car insurance in Lynchburg, Virginia gives drivers many affordable choices. Knowing what affects rates, like where you live, how old you are, and your driving record, helps people find good deals. This way, Lynchburg folks can pick reliable, budget-friendly coverage.

The average monthly premium in Lynchburg is about $107.27, which is lower than the national average. Companies like Mercury Insurance, Utica National Ins Group, and State Farm offer great rates here. By comparing quotes and using discounts, drivers can get the best deals on auto insurance.

Lynchburg is a great place for drivers looking for affordable car insurance. It has a strong insurance industry, rules to follow, and many coverage options. With the help of skilled insurance agents and staying updated on trends, Lynchburg residents can find cheap auto coverage and the best rates for their cars.